The advantages of solar power will become even more evident over time, benefiting your energy costs and carbon footprint. Solar panels can also increase your property's value, and be paid for with a solar panels mortgage.

Our homes are often our biggest asset. Maintaining and improving a home's value is an essential consideration for any homeowner before undertaking a renovation. Many Australians may wonder how solar panels impact both home value and their mortgages.

With the price of electricity in Australia expected to continue rising, installing solar power will only become a better investment in the future. Solar power will usually improve a home's value, more so than other costly improvements like pools or extensions.

In this article we’ll cover all the information homeowners need to know about how solar impacts home values, and how to get financing with a solar panels mortgage.

How do solar panels impact home value?

Solar energy has a positive reputation in Australia and is viewed as an asset to your home that will increase a property's value. In many cases, solar power can be a significant selling point for a home, particularly in remote areas or regions with high traditional energy costs. A recent Real Estate Australia Survey found over 85% of homeowners agreed that a solar array added value to their property.

Studies indicate that when there are more solar panels on the roof, (a larger solar array) the added value of the home will increase. The more solar panels you have, the higher the potential increased value of the home. Homes in Australia typically see an increase of around 6000 dollars per kilowatt of solar energy that the house can produce.

Everyone needs some form of electricity, so solar power benefits not only your own utilities bills but the bills of any future owners. Solar panels can last upwards of 25 years, so, likely, you won't be the only homeowner to benefit from installing them.

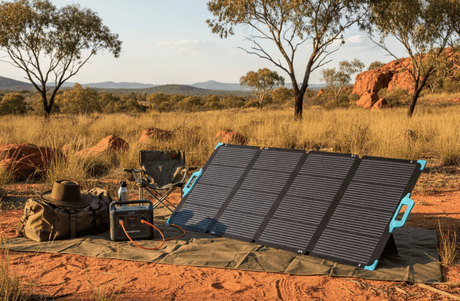

In rural locations, in particular, more Australians benefit from solar electricity. For example, remote rural blocks or farms often have minimal access to utilities like electricity, water, or gas, leaving solar the obvious, or only choice.

Buying a house with solar panels

It's becoming ever more common to buy homes with solar panels already installed. It's estimated that around 2.66 million solar power systems have already been installed on rooftops across Australia.

There are many different benefits of buying a home with solar panels installed. However, these homes may be more expensive, and you may find that these properties are valued higher than similar homes without solar.

If you are new to solar power, here are some key considerations when buying a home with solar panels:

- Ownership: It's important to find out whether the panels are owned outright or leased. Leased solar panels can be off-putting to some buyers and are less appealing. Houses with solar leases sell slower than those where the solar systems are already paid off and have no ongoing costs.

- Efficiency: You should check the solar panels are working as part of your property inspection. Check the efficiency of your panels to ensure they are in good condition. Some DIY solar installations won't work as well as those installed by a professional.

- Warranty: It's also worth checking how old the panels are and how much time is left on the warranty. The value of solar panels, and the property, will increase if there is an extended warranty and many years of life span remaining. Most solar panels in the Australian market come with a warranty of up to 25 years. However, DIY solar installations may not be covered by a warranty, so find out how the panels were installed.

- Quality: You should also check the make of the solar panels and ensure they use premium technology. Newer, higher quality solar panels may command higher home prices and will last longer and produce power more efficiently.

- Type of solar panel: There are different types of solar panels, including polycrystalline, monocrystalline, PERC, thin frame, bi-facial, etc. We recommend that you do your research and compare them to see which would give you the best return on your investment.

Solar power mortgages

The costs associated with solar panels are always upfront. Although there are government initiatives, solar rebates, and tax benefits for installing solar, it can still be a significant expense. The initial costs of installing solar panels can be scary, even with the knowledge that they will pay off long term.

Not everyone can pay for the upfront cost of solar panels in cash. So, if a house doesn't have solar panels already, can you finance them with a solar mortgage? Let's look at how solar power can impact your financing options.

Can I add my solar loan to my mortgage?

Although solar power has many benefits, such as low electricity bills for decades, gaining a mortgage to install solar panels can sometimes be a challenge. Obtaining a mortgage for solar renovations will be different based on the property's location.

Rural properties

Mortgage lenders are not adverse to solar panels. However, some off-grid properties are in remote locations that may have fewer potential buyers. The fact that these homes are remote, not the solar power itself, can be a deterrent for some lenders.

However, many more Australians are looking to escape the city and embrace rural living, which may change the buying market in the future. Additionally, each mortgage lender will have different risk appetites; brokers can often negotiate approvals for properties even if they are in remote locations.

While mortgages for solar panels can be harder to get in rural areas, solar is still a cheaper option for owners than the alternative. For example, installing power poles in remote locations can cost roughly $10,000 per pole, while solar panel installation costs around $5,000 and will save you money in the long run.

Urban properties

There's plenty of potential buyers in metro locations, and solar panels are an asset to the property. For property investors and landlords, lower energy bills can also be a great selling point for any potential tenant.

Are solar panels included in a home appraisal?

Yes! If a property owner owns their solar panels, then the mortgage lender will treat the panels as real property. That means that as long as the panels are owned and not leased, they can be valued in the appraisal.

Are solar panels considered a second mortgage?

A loan for solar panels may be considered a second mortgage. A solar panel mortgage can sometimes be considered a home equity loan. Therefore, when you sell the property, the cost of the solar panel installation will be deducted from the home's equity.

Selling A House With Solar Panels

If your home has solar panels, you're likely in a good position when it comes time to sell. For most prospective buyers, a house with solar panels is an attractive concept. Studies have also shown that solar panels can increase the value of a property by up to 4%. You'll also have a competitive edge in the market, as homes with solar panels can sell up to two times faster than those without.

Is it harder to sell a house with solar panels?

Usually, the addition of solar panels makes it easier to sell a property. Studies have found that homes with solar panels sell for better prices and faster than those without.

However, there are some exceptions.

First, ownership status can impact the sale of some solar-powered homes. If the homeowner is leasing the panels, then a new buyer will need to take over the lease, an extra ongoing expense that may be offputting. There may also be a power purchase agreement (PPA) with a solar leasing company, which can complicate the sale of the house.

Location can also impact how valuable the addition of solar panels is to your home. For example, if you're in a sunny place with high sunlight exposure, your system will have the highest energy output.

Properties in sunnier locales will see significant cost efficiencies from their solar panels. But if you're in an area with low sunlight levels, you'll likely have to supplement solar with grid energy. Therefore, the cost savings won't be as much of a selling point.

Location impacts both the energy efficiency of a home and its property value. Check out the average peak sunlight hours in Australia by state to research your area.

Do you research

Solar panels can improve the value of your home and impact the costs of buying a home as well. Solar panels undoubtedly increase the value of the property both in the sale cost and long-term cost savings. So do your solar research and speak with your real estate agent and mortgage broker before buying or selling a home with solar panels.

To see how much you can save in electricity costs check out our solar panel calculator.

![What Is a DC to DC Battery Charger [Comprehensive Guide]](http://au.renogy.com/cdn/shop/articles/IMG_3829_bd86de74-31d6-49fd-b9d5-265bb723091d.jpg?v=1757582605&width=460)